Increases in land value

Published on 19 May 2023

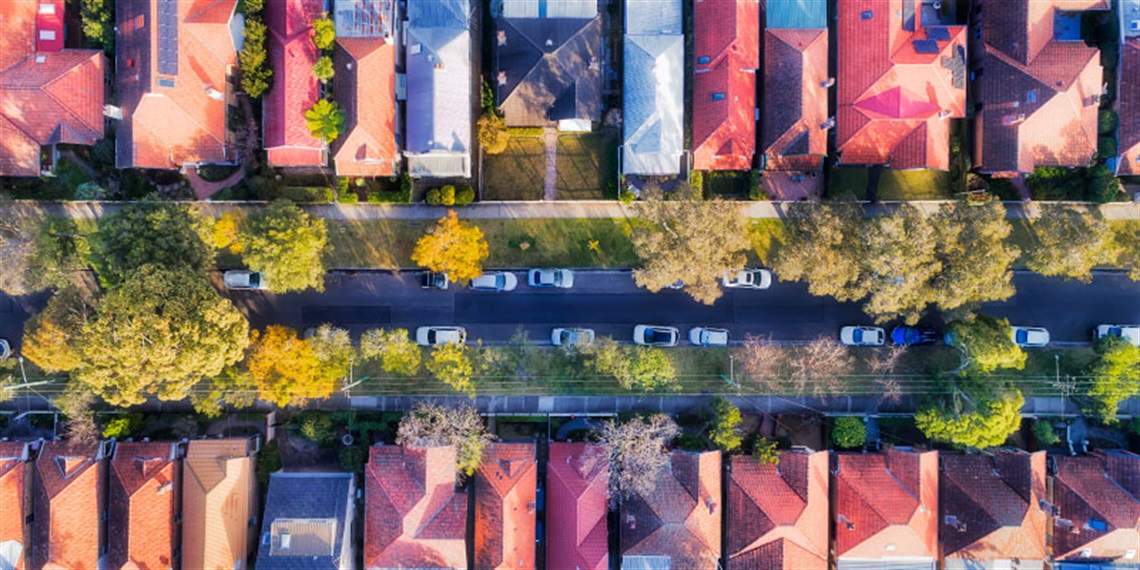

In the Ryde local government area, sales and resales of properties indicated an overall very strong increase in land values between 1 July 2021 and 1 July 2022. The movement was relatively consistent across all market segments. The Ryde local government area continues to be an area in demand due to its proximity and accessibility to central business and employment districts, large shopping centres, good local schools and Macquarie University with strong transportation links including rail and road, waterfront localities, proximity to Sydney CBD, and the continued development of Macquarie Park as a commercial hub of Sydney. Read more on the Valuer General website.

The City of Ryde Local Government Area (LGA) is governed by the Ryde Local Environmental Plan (LEP) 2014 and the Ryde Local Environmental Plan 2010. There have been a small number of LEP amendments since the prior annual and general valuations. Amendment no. 28(PDF, 153KB) in particular has affected large amount of low-density zoned properties resulting in significant value increases to properties that the amendment made suitable for dual occupancy development.

Significant value changes

Summary of valuation changes to residential land - Changes since previous general valuation year (2019)

Overall, residential land values in Ryde showed a very strong increase. From late 2019 continuing into early 2020, the residential market entered a recovery phase, rebounding from falls earlier in 2019. Low-interest rates and easing credit conditions drew buyers back into the market contributing to upward pressure on price growth. COVID-19 impacted the property market from mid-March 2020, both directly and indirectly. The increase is relatively consistent across all sectors, including mixed use, waterfront, low-density residential, medium-density residential, and high-density residential properties, with the exception of low-density zoned properties suitable for dual occupancy sites where the land values of many of the properties have increased by more than doubled. Ryde LEP (Amendment No 28) published on 5 March 2021, allowed dual occupancy development to be permitted on low-density sites that meet certain requirements. This increased the demand of developers to purchase the sites, knocking down existing dwelling(s) and re-developing for a duplex.

Summary of valuation changes to commercial land - Changes since previous general valuation year (2019)

Overall, commercial land values in Ryde showed a very strong increase. In 2020 commercial properties overall had a moderate decrease. Most commercial properties were considered COVID-19 affected and the Valuer General’s COVID-19 report was used to assist in the valuation process for commercial land in 2020 as there were insufficient sales in these affected areas. Post COVID, the commercial market has been growing with strong overall increases in 2021 through to very strong increases in 2022. The increase is relatively consistent across all sectors, such as neighbourhood strip shops, smaller mixed use sites, and the Macquarie Park Commercial Core.

Summary of valuation changes to industrial land - Changes since previous general valuation year (2019)

Overall, industrial land values in Ryde showed a very strong increase. The increase was mainly driven by a scarcity of stock and very strong demand for properties located north of Victoria Road in Gladesville and south of Victoria Road West Ryde.

Read more in the City of Ryde Final Report 2022(PDF, 733KB), prepared on behalf of the Valuer-General.

More information about your land value can be found on the Valuer-General's Your Land Value Factsheet(PDF, 102KB).

FAQs - How Your Land is Valued

Why is your land valued?

Land values are used by Councils for rating and the Office of State Revenue (OSR) for the calculation of land tax.

Rating

Land values are issued to councils for use in calculating rates at least every three years. These land values are fixed for rating until new land values are issued to council.

Land values are one factor used by councils in the calculation of a landowner’s rating liability. Due to Rate Pegging and Council’s Rating Structure an increase in land value does not necessarily lead to similar increases in rates.

What is land value?

Land values in NSW are determined under the Valuation of Land Act 1916.

Land value is the value of your land only. Land value does not include the value of your home or other structures and improvements on your land. However, works including clearing, filling, draining and retaining walls are included in your land value.

When is your land valued?

Land values are determined annually as at 1 July each year and reflect property market conditions at that time.

Who values your land?

The Valuer-General is responsible for providing fair and consistent land values for rating and taxing purposes.

Professional valuation contractors prepare land values for the Valuer General. The quality of the land values are checked by the Valuer General before they are accepted and issued.

How is your land valued?

Most land is valued using the mass valuation approach, where properties are valued in groups called components. Properties in a group have similar attributes and are expected to experience similar changes in value. Benchmark properties are selected from components and individually valued as at 1 July each year to determine how much the land value has changed from the previous year. This change is then applied to all properties in the component to determine their new land values. Sample valuations are then checked to confirm the accuracy of the new values.

What factors are considered when valuing land?

When comparing property sales to the land being valued, valuers consider factors such as

- Property market conditions as at 1 July in the year of valuation

- Most valuable use for the land

- Location of the land

- Constraints on use such as zoning and heritage restrictions

- Land size, shape and land features, such as slope and soil type

- Nearby development and infrastructure

- Views.

Concessions and/or allowances applying to your land under the Valuation of Land Act 1916 will be printed on your Notice of Valuation.

Factors such as personal circumstances, council rates and land tax liability are not considered when determining land value.

Lodging an Objection. Can you have your land value reviewed?

If you disagree with the land value on your Notice of Valuation or a land value included in your land tax assessment, you can lodge an objection with the Valuer General to have the land value reviewed.

Information about objecting to your land value and lodging an objection online is available from the Valuer General’s website, https://www.valuergeneral.nsw.gov.au/land_values/what_if_you_have_concerns/lodge_an_objection. Alternatively, landowners can request an objection kit, which includes an information booklet, valuation objection form and general valuation sales report by phoning 1800 110 038.

Objections must be lodged using the valuation objection form or by using the online objection facility by the last date to object shown on your Notice of Valuation or not later than 60 days from the date of issue of your land tax assessment.